P/e Ratios Tesla

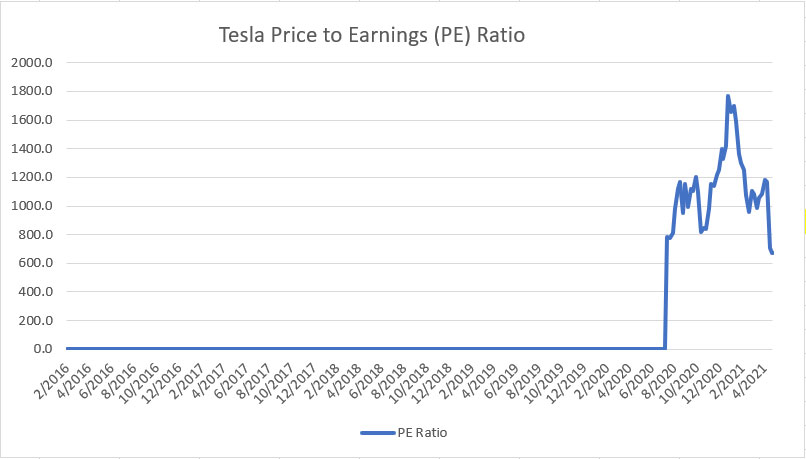

Teslas pe ratio for fiscal years ending December 2016 to 2020 averaged 2151x. This equated to a market capitalization of 101 trillion Risk to Index Investors.

Comparison Of P E Ratio For Major Automakers And Tesla The Auto Industry

Teslas Forward PE Ratio for today is 14156.

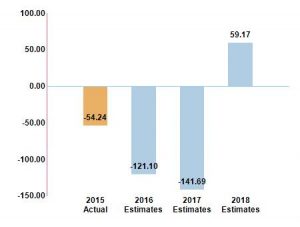

P/e ratios tesla. 48 than aggregate P E Ratio of 15. Teslas pe ratio fwd is expected to average 833x over the next five fiscal years. In January Teslas PE ratio hit an all-time high of 1401 and then dropped to 680 by the end of June.

Its the last thing still propping up the Nasdaq and Arkk. This big fella is the next to blow. The valuation becomes a risk if the company cant deliver on the markets expectations.

Ideally one might believe that Tesla Inc. The PE Ratio or Price-to-Earnings ratio or PE Ratio is a financial ratio used to compare a companys market price to its Earnings per Share Diluted. The past 5-year record for EPS.

Log in or sign up to leave a comment. Pe Ratio Of Tesla Summarized by PlexPage. Why is Tesla PE ratio so high.

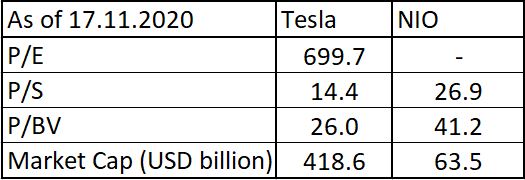

Jan 14 2022 400 PM. Price to Earnings Ratio or PE is price earnings. Has a better P E ratio of 1085.

Teslas latest twelve months pe ratio is 2891x. As long as they remain optimistic the PE ratio is likely to remain high. In the broader market there are very few trillion-dollar companies.

About PE Ratio TTM Tesla Inc. TSLA IEX Real-Time Price USD. 12 of Auto Manufacturers Industry.

TSLA is currently trading with a PE ratio of 103815 compared to the SP 500s 3535. Might perform better in the future than its industry group but it is probable that the stock is overvalue. Has a trailing-twelve-months PE of 20826X compared to the Automotive - Domestic industrys PE of 1926X.

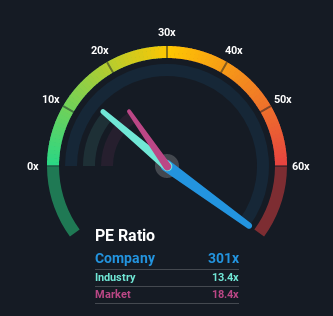

There are many limitations to the P E Ratio. With Tesla still at a PE ratio of around 300. General Latest Info.

Tesla now has a price-earnings PE ratio of 332. 1805 175 At close. Jan 14 2022 759.

The stock has gained huge momentum due to its recent developments. 46 rows Tesla PE ratio as of January 20 2022 is 32222. Please refer to the Stock Price Adjustment Guide for more information on our historical prices.

Investors are clearly very optimistic about Teslas future. Earnings per share this year grew at an 2340 rate. Price-to-earnings ratio is one of the most widely used metrics by investors and analysts to determine stock valuation.

But a high PE ratio does indicate that the market has high expectations for a company. It is the most widely used ratio in the valuation of stocks. Tesla PE Ratio Calculation.

In addition to showing whether a companys stock price is overvalue or undervalue P E can reveal how a. 02 July 2021 If you want to update the article please loginregister. Teslas PE Ratio for today is 33235.

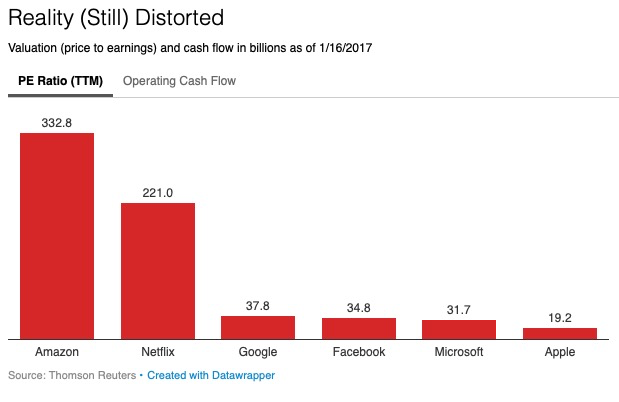

Teslas pe ratio fwd is 1372x. Looking back at the last five years Teslas pe ratio peaked in December 2020 at 12741x. A higher PE ratio makes sense for Tesla because it has vastly more depreciable assets than NVIDIA but even going by the EV-to-EBITDA ratio which strips out depreciation NVIDIA sports a.

Log In Sign Up. Price to Earnings Ratio vs. Shares of Tesla jumped by 127 to 102486.

The PE ratio of Tesla is 37027 which means that it is trading at a more expensive PE ratio than the market average PE ratio of about 1880. Teslas PE Ratio for today is calculated as. In October 2020 the PE ratio of the tech giant stood at around 875.

It gave Tesla a price-to-earnings ratio a standard measure of a stocks value close to 1700. Teslas PE Ratio without NRI for today is 33235. What is the P E ratio of Amazon.

47 rows The PE ratio can be viewed as the number of years it takes for the company to earn. Many stocks down 40-70. Secto Find real-time TSLA - Tesla Inc stock quotes company profile news and forecasts from CNN Business.

The automotive industry PE ratios generally fall between 10 to 30 depending on expected results. 26 rows In depth view into Tesla PE Ratio including historical data from 2010. Mod 2 days ago Stickied comment.

Statistics show the companys price-per-earnings ratio more than halved in the following week falling to around 350 in the first days of July. Teslas operated at median pe ratio of -372x from fiscal years ending December 2016 to 2020. By the end of the year this figure jumped to over 1300.

Financial analysts and individual investors use PE Ratio and PEG ratios to determine the financial performance of a business entity when making investment decisions. TSLA designs develops manufactures and sells electric vehicles electric vehicle powertrain components and stationary energy storage systems in the United States China Norway and internationally. They are the top five companies by market.

It is sometimes difficult to determine the nature of earnings. Teslas is expected to deliver median pe. Its price to book value ratio is 141 much lower than that of the SP 500 which comes in at above 4 right now.

What Is The P E Ratio For Tesla Quora

Tesla And Apple Valuation Questions By Jean Louis Gassee Monday Note

Tesla Inc S Nasdaq Tsla Fundamentals Are Improving But Valuation Remains A Risk Nasdaq

Explore Tesla Stock Valuation With Only 8 Ratios Fundamental Data And Statistics For Stocks

Posting Komentar untuk "P/e Ratios Tesla"