P/e Ratios Of S&p 500 Companies

The highest ever ratio is 12373 which was measured in May 2009 after the market crash and the lowest was 531 found in December 1917. PE Forward of SP 500 Index Constituents 2021.

Why Was S P 500 Pe Ratio So High On May 2009 Personal Finance Money Stack Exchange

Current Status of the PE Ratio The SP 500 PE ratio as of June 1 2017 was 257x which is 3247 higher than the historical average of 194x.

P/e ratios of s&p 500 companies. It offers a way to compare various stocks by normalizing their price into a multiple of their earnings. MetLife is an insurance holding company. The SP 500 Index is a listing of the largest 500 companies by market capitalization traded on the US.

The charts as interpreted by Mark. Provides insurance annuities employee benefits and asset management. The SP 500 Index is a listing of the largest 500.

In fact the PE Ratio is higher than the long-term average and the current PE in 8 of the 11 sectors. SP 500 PE Ratio chart historic and current data. It is calculated by simply dividing the price for a share of a stock by the earnings per share of a stock.

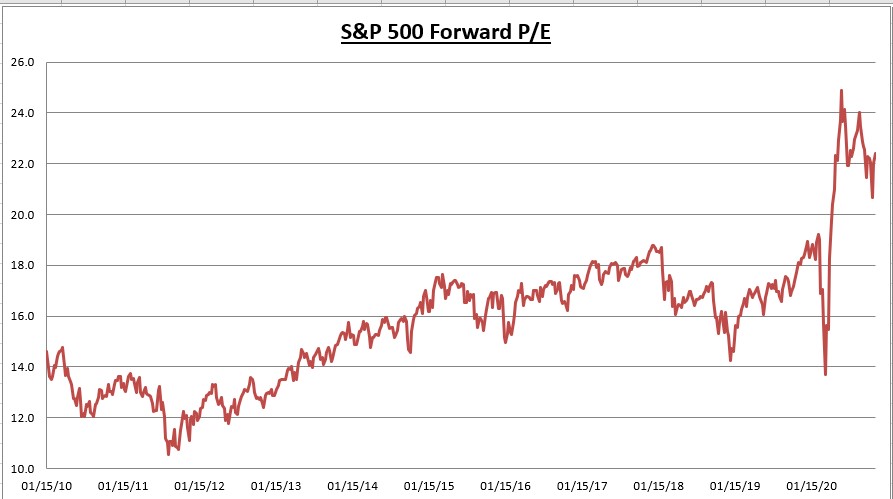

The current PE Ratio of the SP 500 is 2222 which is above its long-term average of 194. Forward 12 months from Birinyi Associates. What is the historical PE ratio for the SP 500.

This page lists companies that have unusually low price-to-earnings ratios PE Ratios which is a common financial ratio used for valuing a stock. This chart SP 500 PE Ratio - 90 Year Historical Chart shows that in 2008 it reached 120 and came back to normal real fast. By The Online Investor Staff updated Sat Jan.

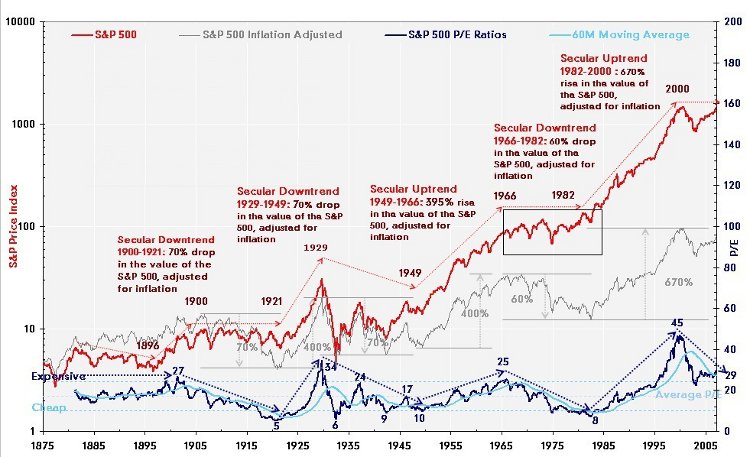

It is typically used as the benchmark against which all US. A higher PE ratio means that investors are paying more for each unit of net income making it more expensive to purchase than a. Since 1936 the SP 500 PE ratio for trailing as reported earnings has ranged from 59 in June 1949 to 602 in December 2008.

Through its subsidiaries and affiliates Co. PE ratio will be derived by dividing the aggregate current prices of the stocks of SP 500 companies by the aggregate earning per share of the stocks of said companies. 505 rows SP 500 Index.

Forward price-to-earnings PE is a valuation factor for assessing stock fundaments and it is calculated using the forecasted earnings for the PE calculation. It is calculated by simply dividing the price for a share of a stock by the earnings per share of a stock. Updated weekly on Friday.

Some evidence can be found just looking at the multiple of the SP 500. Historically it has traded in. 26 rows SP 500 PE Ratio is at a current level of 2456 down from 2707 last quarter and down from 3424 one year ago.

MET PE Ratio. The term beat the market usually refers to an. This is a change of -926 from last quarter and -2826 from one year ago.

Show Recessions Log Scale. 25 Top Lowest PE Ratios in the SP 500. CNBCs Jim Cramer said Friday that technical analysis of Wall Streets so-called fear gauge indicates the SP 500 faces a challenging outlook in the near term.

A stocks PE ratio is calculated by taking its share price and divided by its annual earnings per share. This ratio is in the 84th percentile of the historical distribution and was only exceeded during the early 2000s and the 2008-2009 recession. This is a change of -926 from last quarter and.

Thus SP 500 PE Ratio Aggregate Current Price of SP Stocks. SP 500 PE Ratio - 90 Year Historical Chart. Trailing 12 months.

This interactive chart shows the trailing twelve month SP 500 PE ratio or price-to-earnings ratio back to 1926. Using the as reported actual earnings as a measurable category the following table gives you a comparison for prior years. Stock Exchanges including companies traded on both the Nasdaq and the New York Stock Exchange NYSE.

The PE ratio is about earnings and not dividends so it tells you that on paper you will recover your investment in 23 years but almost no company pays their entire earnings in dividends. SP 500 Stocks by Lowest PE Ratio. Current SP 500 PE Ratio is 2508 a change of -048 from previous market close.

PE data based on as-reported earnings. SP 500 FORWARD PE RATIOS COMMUNICATION SERVICES Communication Services Sector 202 Advertising 130 Broadcasting 97 Cable Satellite 146 Interactive Home Entertainment 181 Interactive Media Services 245 Movies Entertainment 375 Publishing 237. In fact many of them never pay dividends at all.

The trailing PE of 264 is 51 higher than the historical average trailing year PE ratio of 175. 153 rows SP 500 PE Ratio table by year historic and current data. The Price-to-Earnings PE Ratio is one of the most well-known ratios for valuing a stock.

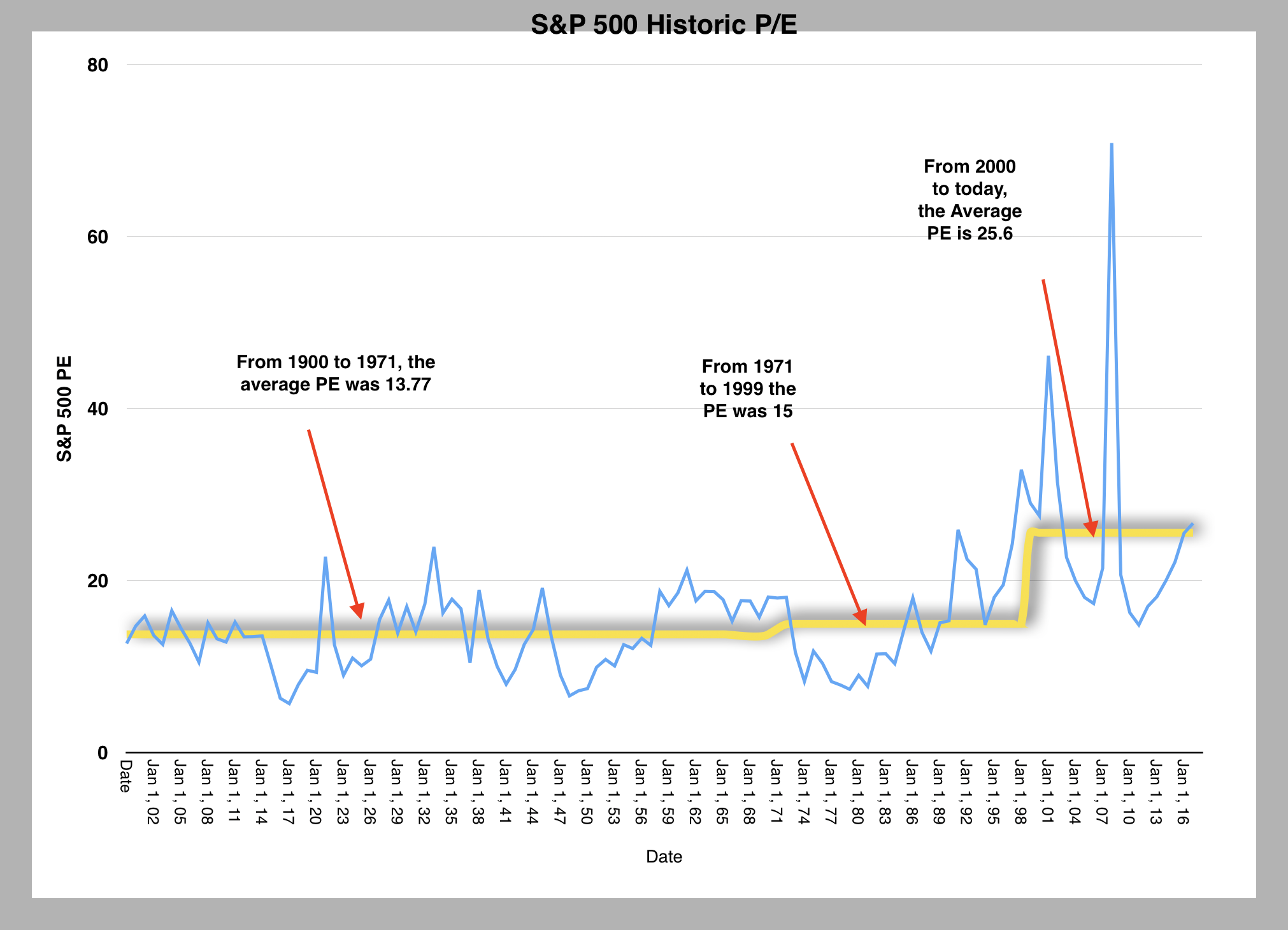

As of November 10 2021 the SP 500 was at 4641 and had trailing year PE ratio of 264 and a forward PE ratio based on expected earnings in the next four quarters of 229. According to historical data the SP 500 average PE ratio was 1334 between 1900 and 1980 while the average ratio has changed to 2192 19812020 over the next 40 years. The Price-to-Earnings PE Ratio is one of the most well-known ratios for valuing a stock.

The average PE ratio over this period was 1598. The SP 500 Index. The SP is now trading at 196 times 2022 estimates.

SP 500 Stocks by Highest PE Ratio. It is calculated by taking the current stock price and dividing it by the forward projected earnings per share EPS which may be based on. It offers a way to compare various stocks by normalizing their price into a multiple of their earnings.

Continue to slide 2.

The S P 500 P E Ratio Is The Highest It S Been Since The Great Recession And The Dot Com Crash Is This Because Of The Pandemic Will The Ratio Come Down As Personal

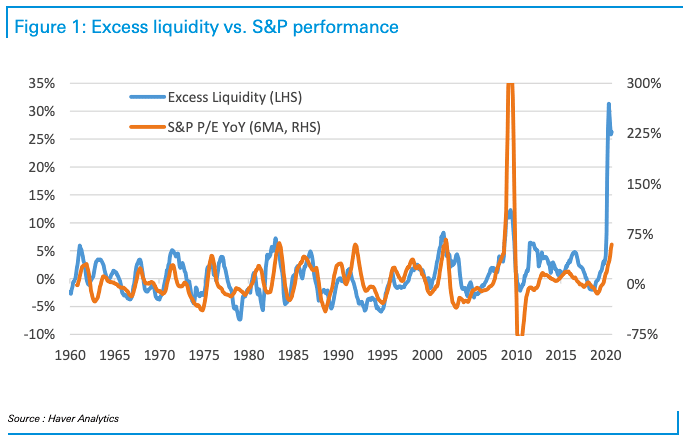

Excess Liquidity And The S P 500 Pe Ratio The Sounding Line

S P 500 Earnings Update Investing Com

Why A 25 P E For The S P 500 Might Be The New Norm Seeking Alpha

S P 500 Pe Ratio How The Price Earnings Ratio Helps You To Valuate The Companies In The Standard And Poor 500 Undervaluedequity Com

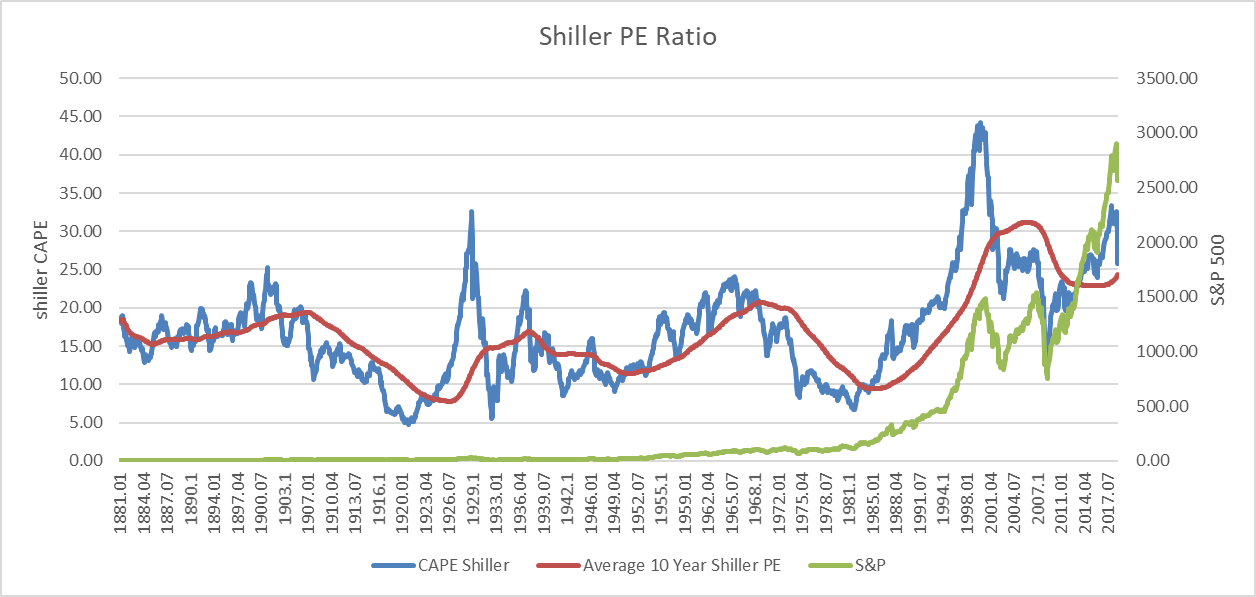

Using The Shiller Pe The S P 500 Won T Look Overvalued For Long Seeking Alpha

Posting Komentar untuk "P/e Ratios Of S&p 500 Companies"